I would like to have practiscore donation be placed in a separate transaction directly to practiscore and not passed through my clubs stripe account. This places and additional burden on the clubs from an accounting perspective We need to understand how this will appear on the K-1099 form issues by Stripe at the end of the year for taxes. The Stripe K-1099 reports gross charges – Stripe does deduct fees or refunds. My club is a nonprofit corporation, we have to provide an accounting for all the funds. The latest announcement StoreFront update #2 Comped matches, double payments and CC charges where practiscore is going to refund the 3% fee this only adds to the complications of the clubs and the accounting of funds.

Currently, the clubs using Practiscore website and accept online payments with Stripe are forced to allow Practiscore donations to pass through the Stripe account.

At a minimum, Practiscore should give each club the option opt-out of having the donations passed through the stripe account with match fees. If Practiscore wants to have a Donation option required on each match, add a link to the Practiscore dedicated Donation page Home | PractiScore and provide a one time donation option to the page.

That refund was to handle the situation where the club paid a transaction fee on the PS donation part. It covers just past things where that happened. It hasn’t happened since discovered and fixed. The refunds are to make the clubs where that happened whole.

For transactions from that point on the club sees it’s money and it’s expected transaction fees, and PS sees it’s donation less the transaction fees on that portion. I’m not sure how that messes up accounting. I’d like to know more.

Doing separate charges will make $1 donations (or lower) unfeasible. We’d just not do it.

Tell me more about how this messes up club accounting?

Ken N.

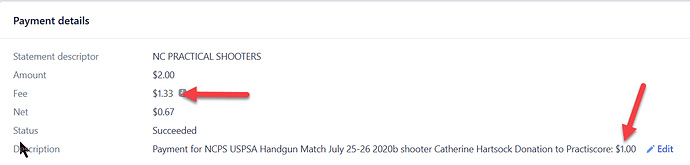

The other place where there is a hiccup is when you do a refund for a withdrawal that had a $1 donation to PS. My fees went from 1.47 to 2.59 for a match fee with a $1 donation refunded by me not practiscore. I didn’t realize why until Jim’s comment.

1 Like

Just an update.

We have folks looking at things this week.

D.J.

2 Likes

@KenNelson

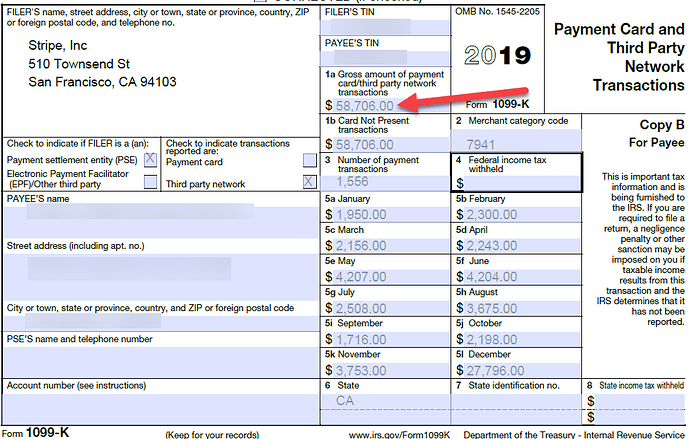

When we get the K-1099 form from Stripe for Taxes is only show the Gross income. and not any reporting of fees or refunds.

We have to track the fees paid and refunds separately in our accounting software for Tax purposes

Now with Practiscore donation appearing as a fee

We need to track every donation to Practiscore in our accounting software. In addition when a refund is done from Practiscore the refund is not sent directly back to the competitor it is refunded to our Stripe account and we must to a separate refund back to the competitor from our Stripe account and track those in our accounting software for Taxes. We will also need to figure out a way to report the Donations that have passed through our account to the IRS with all the Tax information for Practiscore.

Will Practiscore be notifying the club when Practiscore issues a refund of a donation to a competitor that has contacted Practiscore directly for a refund?

All of this accounting is done by our volunteer treasurer.

In my business this practice would be a violation of the Unfair or Deceptive Acts and Practices violation, and a regulator would slap you hard…

I sure hope that practiscore can get this ironed out before the stink sticks…

1 Like

I have been associated (by using it) with practiscore for many years and I would bet real money this is not an intentional misdeed. Maybe you should volunteer to help them navigate the complexities of this arcane activity.

I’d love to help if he needs a CFO, but my guess is no…lol

The best I can do is help shed light on the problem and the optics… the people here only want success for PS

At this point I dont think its intentional or that money is motivation… but it does look bad.

question: if one hypothetically donates 100,000 to PS, when i do my taxes will it look like I made 100K over my normal profit?

For taxes… it would be easy enough to show you didn’t receive the money should stripe include it on your 1099 (that is actually a common issue). The bigger problem is that you would get stuck with the credit card processing fee which would be several thousand…

On the 1099-K form from Stripe it would only show the Gross amount of payments. you would need to account for the Donation separately for Taxes. A single large donation would be easy to mange but think about if half of your registered shooters donated $1 at every match. Now you have to track a couple of hundred extra transactions through your clubs account each year.

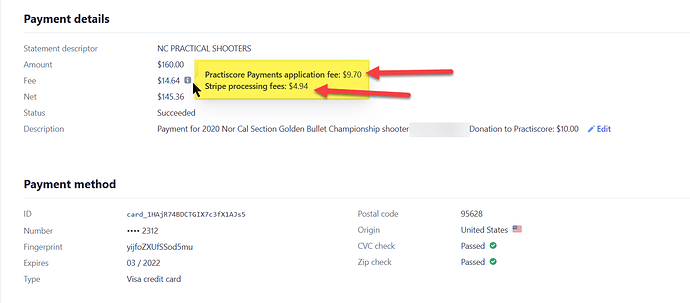

We had another donation this weekend and the donation amount to practiscore is reduced by the fee amount. Our real issue is how to report the fees when you look at the financial reports these fees are not broken out

The reports just show fees of $14.64

In the description of the transaction it states “Donation to Practiscore $10.00”

I have looked into the custom reporting features of Stripe but they have an additional cost

https://stripe.com/docs/reports/custom-reports either to stripe or with 3rd party accounting systems.

I would really like to know how other clubs are handling this accounting issue with Stripe, am I missing something ?

I’ve been directly tasked with researching this issue as it regards to Stripe.

Here is my understanding of what the questions are:

-

Are the transactions labeled “Donation to Practiscore” (transaction fee) reported on the club’s K-1099?

-

How are the associated fees with the donation accounted for?

-

Is there some way to easily get a report of the fees for bookkeeping purposes?

Does this fairly summarize the questions that need resolving?

Jim, what date is the transaction you posted the screenshot?

I am goign to reply to each question in order:

-

Are the transactions labeled “Donation to Practiscore” (transaction fee) reported on the club’s K-1099?

Answer:

I know fees are not reported on the K-1099 form I have put a scren capture of the 2019 in a previous post. We as a club must account for the fees in our accounting system, we use QuickBooks. Since the Donations are included as fees in Stripe. I am assuming the Donations will not be separated out on the 10099-K since there is not a field on the form.

-

How are the associated fees with the donation accounted for?

Answer:

This is our biggest struggle with the process having the donations pass through our clubs stripe account. We need to account for these donations and report them in our taxes.

-

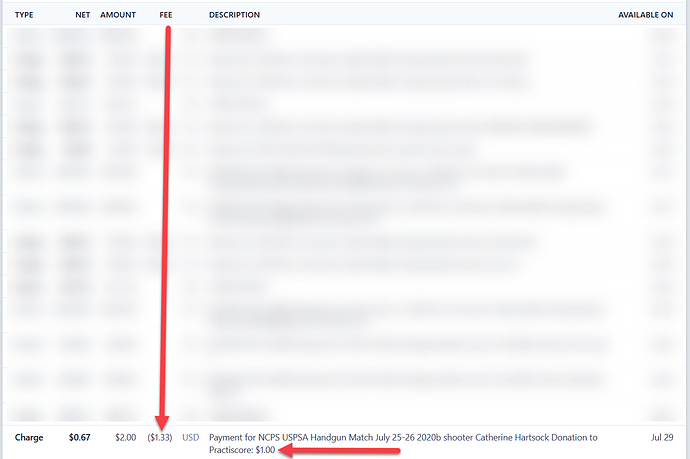

Is there some way to easily get a report of the fees for bookkeeping purposes?

Answer:

The Stripe reports I have found do not break out the fees to show how much is to Stripe and How much is to Practiscore.

Does this fairly summarize the questions that need resolving?

Answer:

I have tried to provide clarification on each of the above questions. But But ultimately I do not feel the clubs should be forced the clubs take on this additional accounting. Practiscore implemented a change that has forces them to allow donations to Practiscore to pass through the Stripe account. This puts an additional burden on the club. Our only choice is to accept this burden and keep using stripe for online payment or to stop accepting on-line payment through Practiscore and Stripe. There is no option for opting out of having Practiscore donations funds passing through the clubs Stripe account.

Jim, what date is the transaction you posted the screenshot?

Answer:

I have posted two screen shots of transactions the $2.00 transaction was on 7/25/2020, and the $160.00 transaction is dated for 7/30/2020

If you need more details on our accounting I can put you in touch with our Club Treasurer.

Thank you for more clarification and the additional information. I am going to be spending the next few days meeting with our engineers, talking to Stripe and possibly our own CPA to get a greater understanding of these issues and offering answers and best practices as I find them.

I want to reiterate on behalf of Practiscore: The option we have added allowing clubs and match directors to add a contribution for PS through match fees is ABSOLUTELY optional. There is no “force” or requirement that it be done. We greatly appreciate the contributions either directly to Practiscore or through match fees.

The only option the club has is to include or not to include a donation with the match fees.

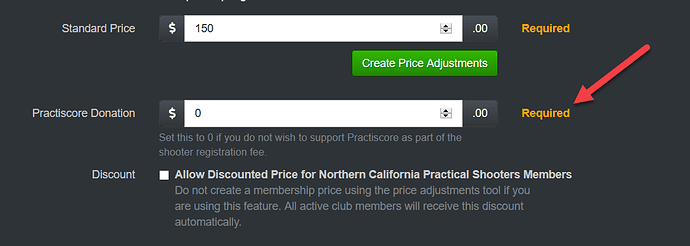

I cannot do not see any option for the club to Opt-out of having the donation field available to the competitors when paying match fees. The Practiscore Donation field is a required field when creating a match and not optional if I have match fees paid on-line.

When a competitor does choose to make a one time donation with their match fees using this option the clubs is FORCED to allow the donation to pass through the clubs Stripe account.

I have been asking for the Practiscore Donation field to be optional so we as a club can choose if we want to take on the added administrative tasks for the donations.

1 Like

doesn’t setting it to zero not allow shooters to donate? According to what the instructions below it say.

Eddie,

Setting the donation level to zero is a match directors choice to support or not.

The shooter gets an option to add support money when they check out no matter whether the MD supports PS or not.

We have always had a lot of shooters that wanted to help with a little extra cash.

Regards,

D. J.

1 Like

This donation field is supposed to be OPTIONAL and HIDEABLE by the Match Director. I’m more than a bit irked it isn’t. It will be by close of business today. I apologize for missing this. It was NOT my desire or INTENT to have this presented unless the MD wanted it to be.

Paula is still digging into the Stripe/accounting concerns. When I approved this I was told that they were like fees, which all clubs were already dealing with on an accounting level. She will report later.

Ken N.

4 Likes

Thank you Ken. Please let me know if you need me to provide any additional details or reports from our Stripe account.